Under the Hood of a Living Benefits Policy

Living Benefits life insurance policies come enhanced with a collection of built-in “accelerated benefit riders”. These ABRs create an additional layer of protection for life’s uncertainties. In addition to the policy’s death benefit, Living Benefits can provide payout options while you’re still alive for Terminal Illness, Chronic Illness, Critical Illness, and Critical Injury.

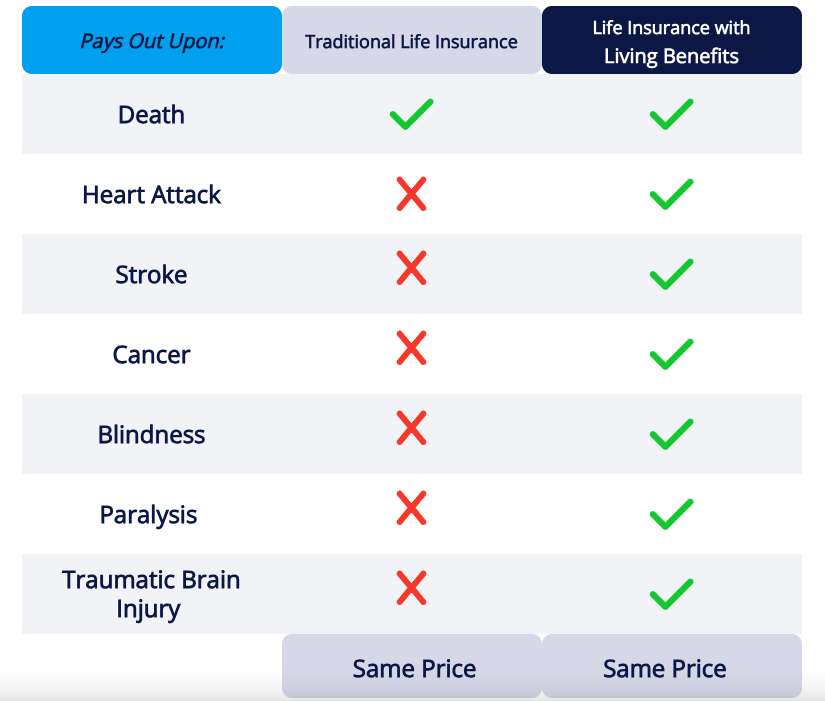

Access funds when you need them the most—whether you’re facing a terminal diagnosis, need help with daily living due to a chronic condition, or experience a severe health event like cancer, heart attack, or stroke. These additional payout triggers are what set a Living Benefits policy apart and make it such a valuable upgrade over a death benefit-only policy.

Do More With Your Life Insurance Policy.

More For The Same Price: Living Benefits give you more options, more flexibility, and more protection – all for the same price as an old-fashioned life insurance policy that only pays out if you die. It’s a no-brainer.

What Is Living Benefits Life Insurance?

Living Benefits life insurance represents a modern twist on life insurance coverage. A policy featuring living benefits riders (also known as accelerated benefit riders, or ABRs) will grant “early access” to the policy’s death benefit while the insured party is still alive if they are to suffer any of the triggering conditions contained in that policy’s living benefits riders.

Provides peace of mind

Comes with your policy

No extra cost