Real Money – When You Really Need It

Hundreds of thousands of real-life Living Benefits policyholders have experienced the ultimate sense relief and peace of mind that come with a much-needed cash infusion when an unexpected health crisis occurs.

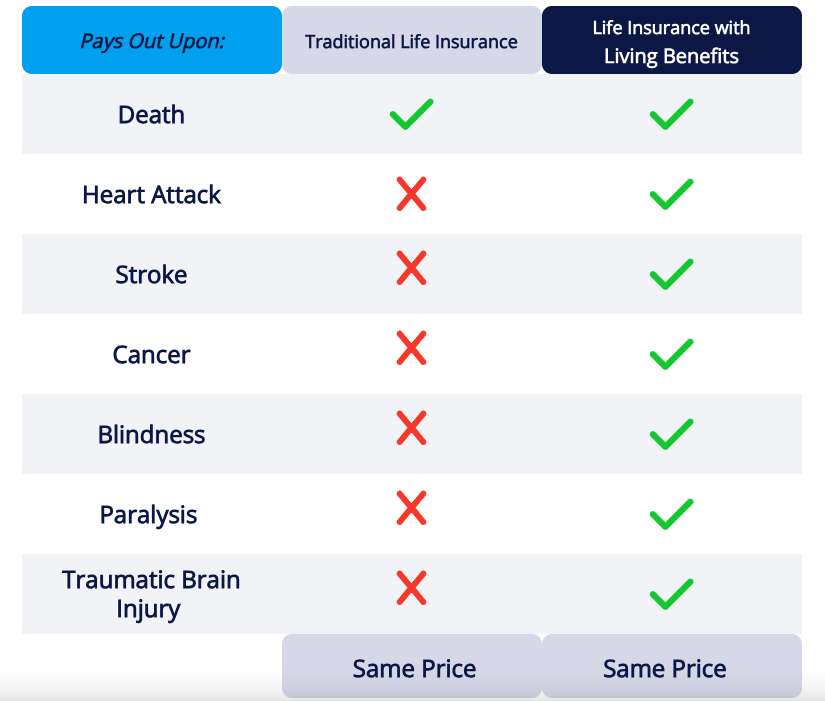

If any of these clients had been covered with a traditional life insurance policy instead, they would have received nothing. Owning a Living Benefits policy ensures that you have access to the money you need, when you need it. It might be the best financial decision you ever make!

Do More With Your Life Insurance Policy.

More For The Same Price: Living Benefits give you more options, more flexibility, and more protection – all for the same price as an old-fashioned life insurance policy that only pays out if you die. It’s a no-brainer.

What Is Living Benefits Life Insurance?

Living Benefits life insurance represents a modern twist on life insurance coverage. A policy featuring living benefits riders (also known as accelerated benefit riders, or ABRs) will grant “early access” to the policy’s death benefit while the insured party is still alive if they are to suffer any of the triggering conditions contained in that policy’s living benefits riders.

Provides peace of mind

Comes with your policy

No extra cost