Living Benefits vs. Traditional Life Insurance

- Suzie has a Living Benefits policy for $500,000 that costs her $50 per month.

- Rachel has a traditional life insurance policy for $500,000 that also costs her $50 per month.

- Which of these two is getting the most value out of their premium dollar, and why?

Do More With Your Life Insurance Policy.

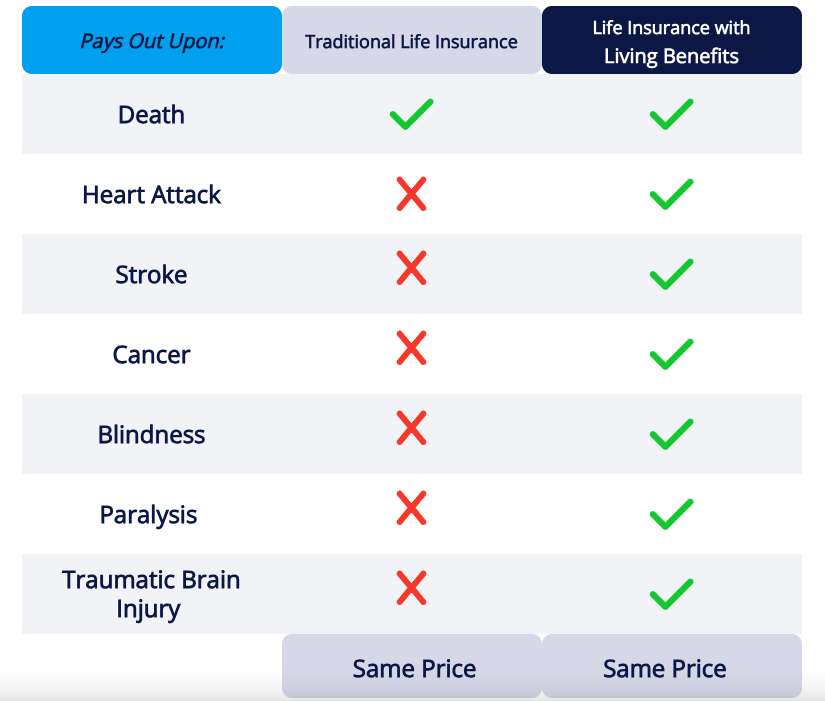

More For The Same Price: Living Benefits give you more options, more flexibility, and more protection – all for the same price as an old-fashioned life insurance policy that only pays out if you die. It’s a no-brainer.

What Is Living Benefits Life Insurance?

Living Benefits life insurance represents a modern twist on life insurance coverage. A policy featuring living benefits riders (also known as accelerated benefit riders, or ABRs) will grant “early access” to the policy’s death benefit while the insured party is still alive if they are to suffer any of the triggering conditions contained in that policy’s living benefits riders.

Provides peace of mind

Comes with your policy

No extra cost